Mohamed NufaijOct. 9, 2025

If you’ve worked with inventory in Odoo before, you know how tricky valuation can get — from tracking stock costs to syncing accounting entries. With Odoo 19, things are changing.

The new release introduces a simpler, smarter approach to inventory valuation, reducing complexity in real-time accounting while making periodic valuation more practical for businesses.

In this blog, we’ll cover the key functional and technical changes in Odoo 19 inventory valuation, and explain why they matter for both accountants and business owners.

Here’s what’s new on the functional side:

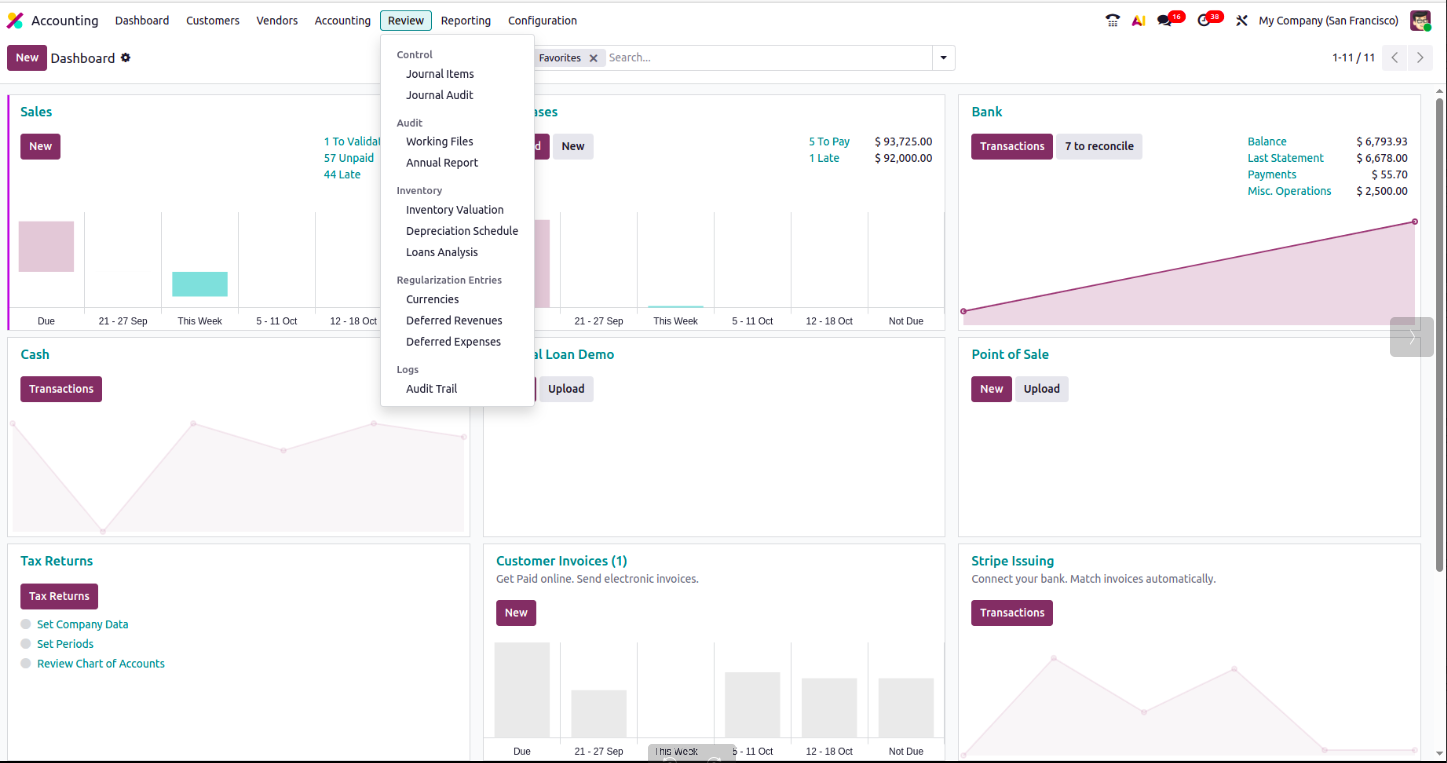

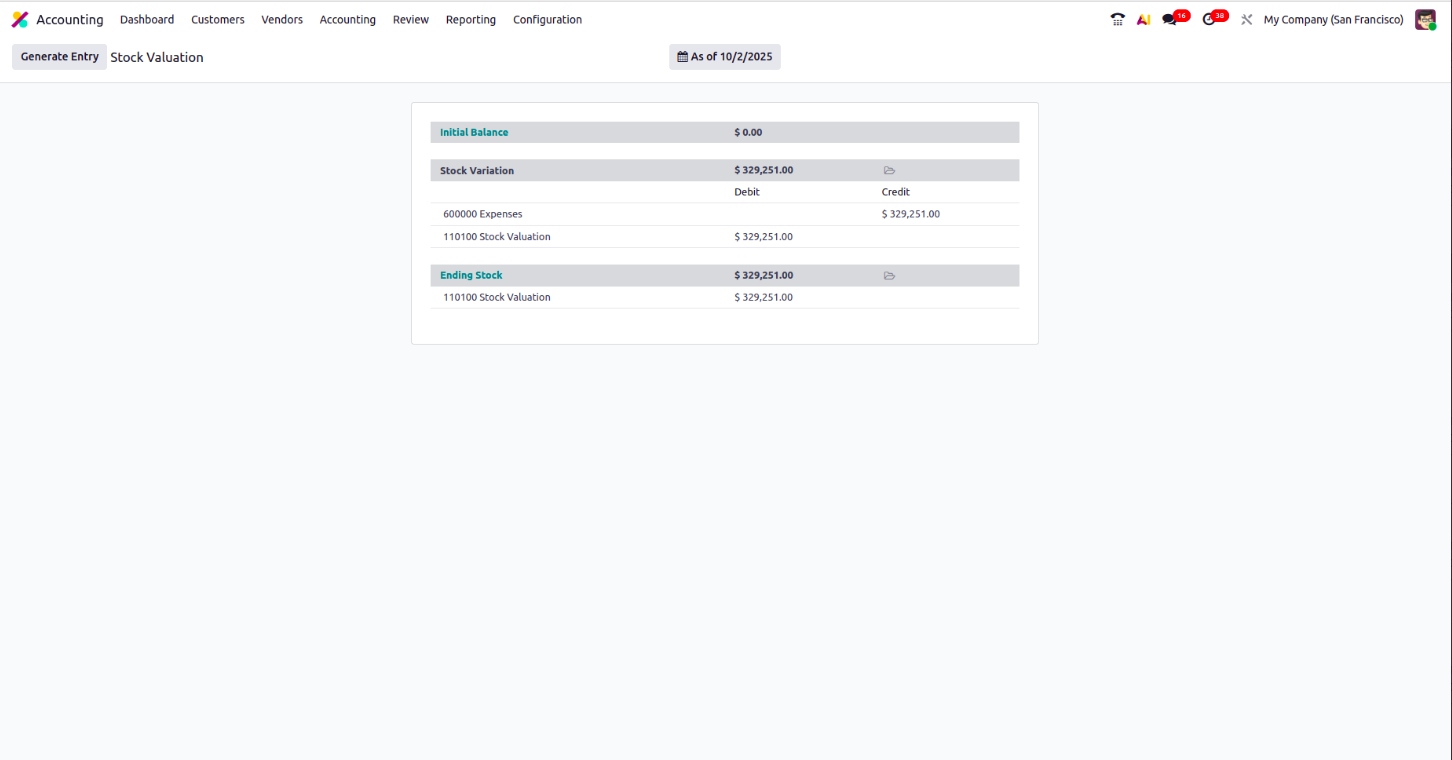

Periodic valuation entries are now handled more smoothly. Instead of relying on manual calculations, Odoo automatically suggests closing entries.

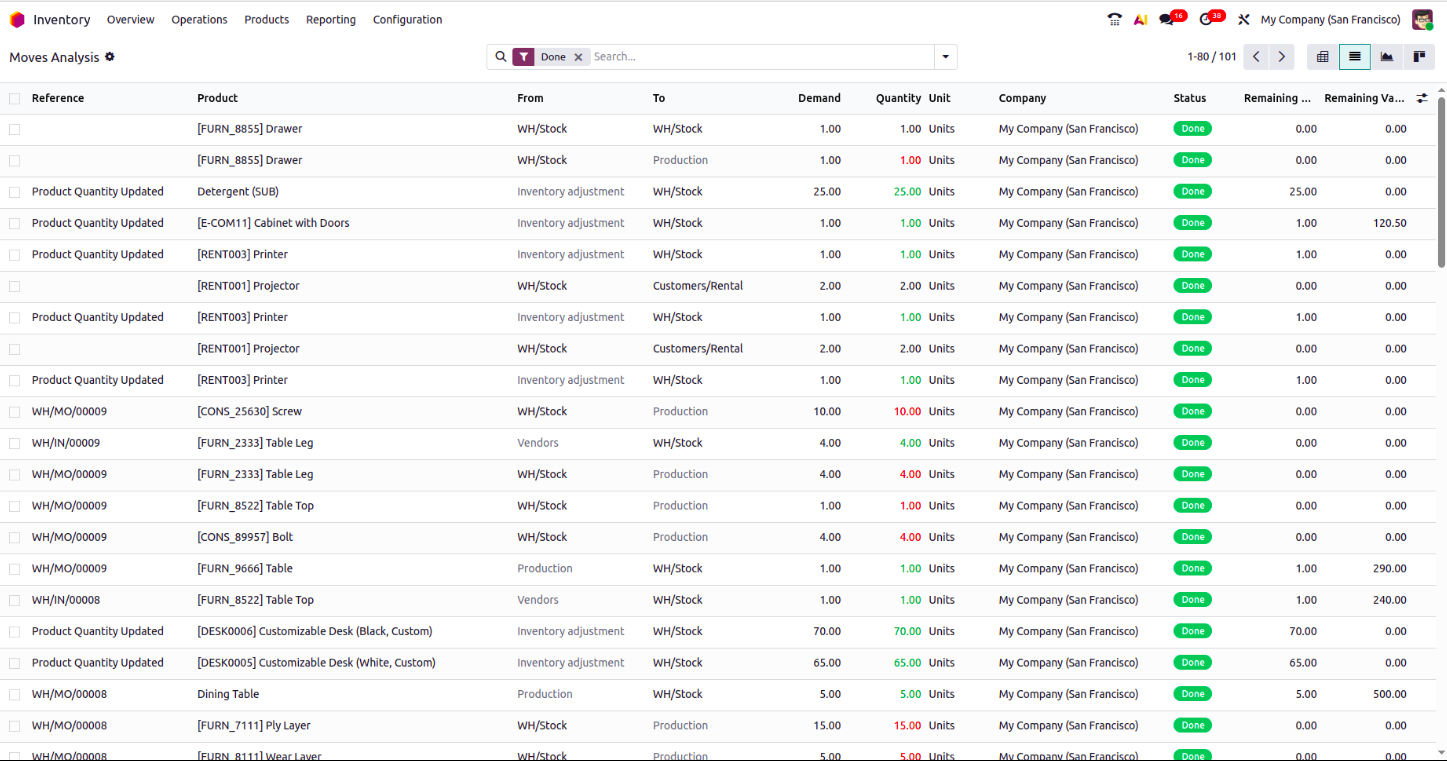

Odoo now manages goods that are:

This ensures your closing reports reflect reality and make it easy to post accruals.

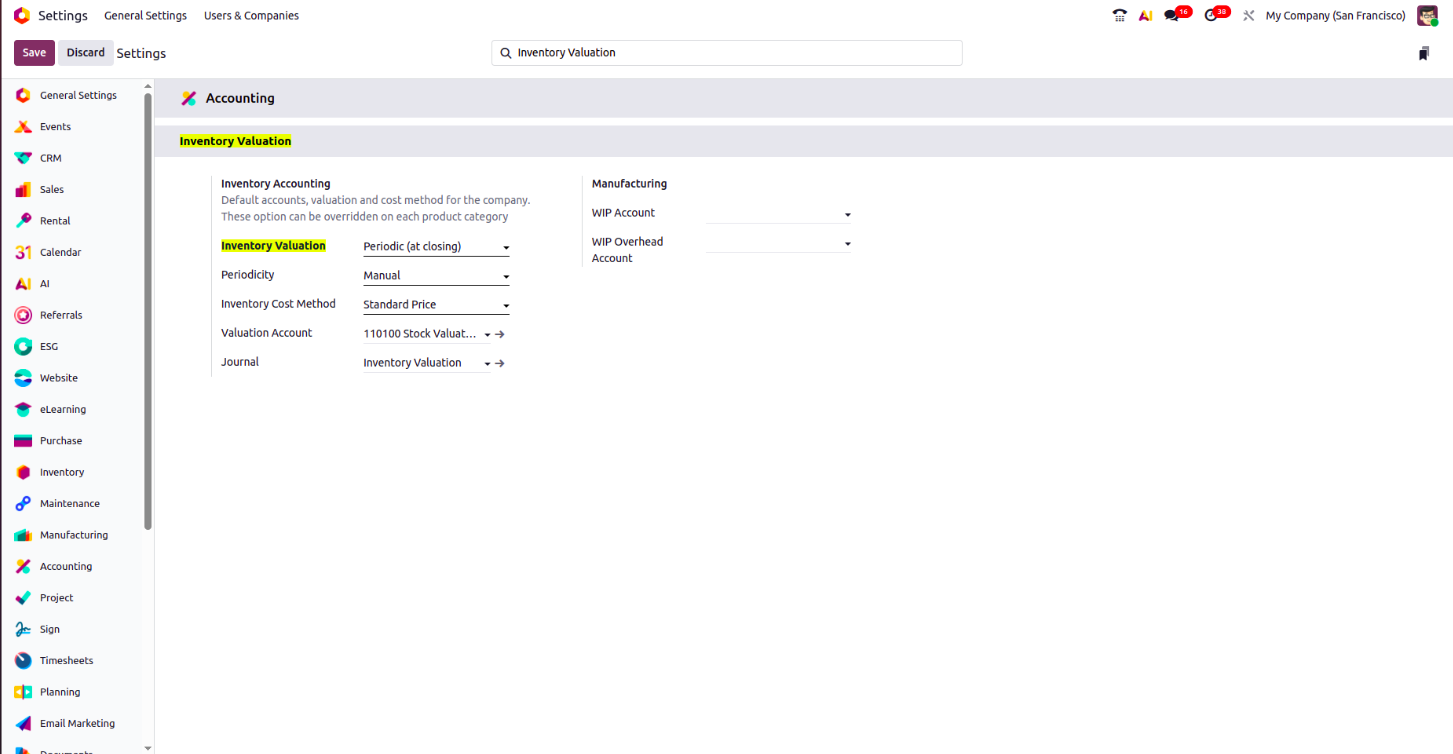

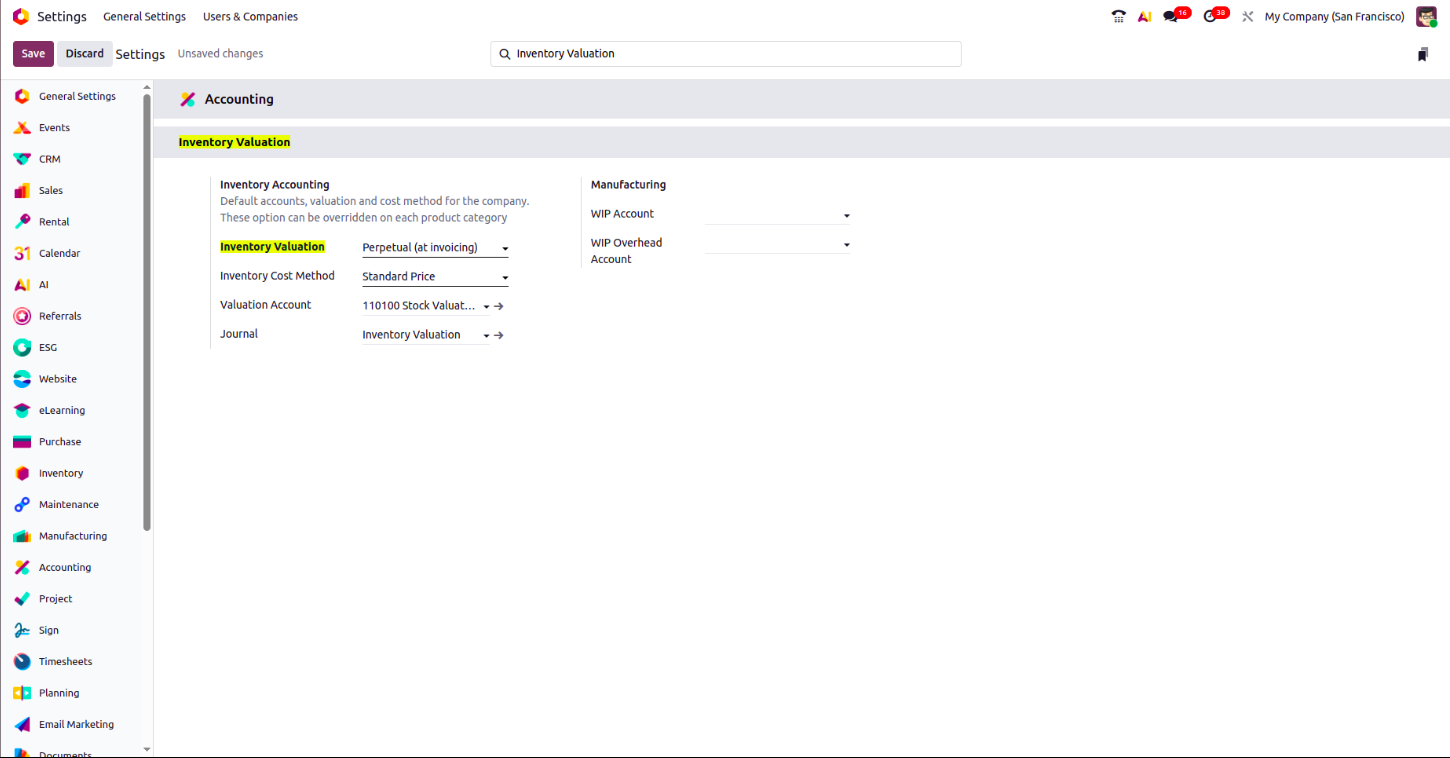

Previously, real-time accounting entries were created at delivery/receipt.

In Odoo 19, valuation happens only when invoices or bills are posted, reducing unnecessary complexity.

The system no longer uses input and output accounts for interim postings. Instead, pending goods are clearly listed in the closing report, and accrual entries can be created as needed.

Odoo now automatically handles the end-of-period or real-time closing, reducing manual effort and reconciliation errors.

Common issues such as backdating and rounding errors are managed automatically during closing, ensuring more reliable reports.

For those interested in the technical side, Odoo 19 brings some major backend updates:

The changes in Odoo 19 aim to:

Imagine you deliver products to a customer but haven’t issued an invoice yet.

This approach makes financial statements cleaner and easier to justify.

Odoo 19 reshapes how inventory valuation works. By shifting real-time valuation to invoices and bills, removing input/output accounts, and automating periodic closing, it strikes a balance between simplicity and accuracy.

For businesses, this means less complexity and more reliable reports. For accountants, it means fewer manual adjustments and better compliance.

👉 What do you think about these changes? Do they make inventory valuation easier for your business? Share your thoughts in the comments!

Yes, costing methods like FIFO, AVCO, and Standard Price are still available. The change is in how valuation entries are handled.

Because valuation is now based directly on accounting documents (stock.move), making the process simpler and faster.

These appear in the closing report. You can then post accrual entries for accurate reporting.

Yes, but Odoo 19 manages backdating errors automatically during the closing process.

Both SMEs and large companies — anyone who struggled with reconciling real-time stock and accounting in previous Odoo versions.

0