Asharaf.KSept. 7, 2023

The world of taxation and compliance can be a daunting landscape for businesses, and India's Goods and Services Tax (GST) regime is no exception. Keeping up with the intricacies of GST reporting is essential to ensure your business remains compliant and efficient. Fortunately, Odoo 17, the versatile business management software, has arrived to simplify this process.

In this blog, we'll delve into how Odoo 17 revolutionizes GST reporting, making it more accessible and manageable than ever before.

GSTR 3B is your monthly summary return. It reveals your monthly supplies, GST liability, input tax credits, and more. It's also your ticket to settling any outstanding taxes.

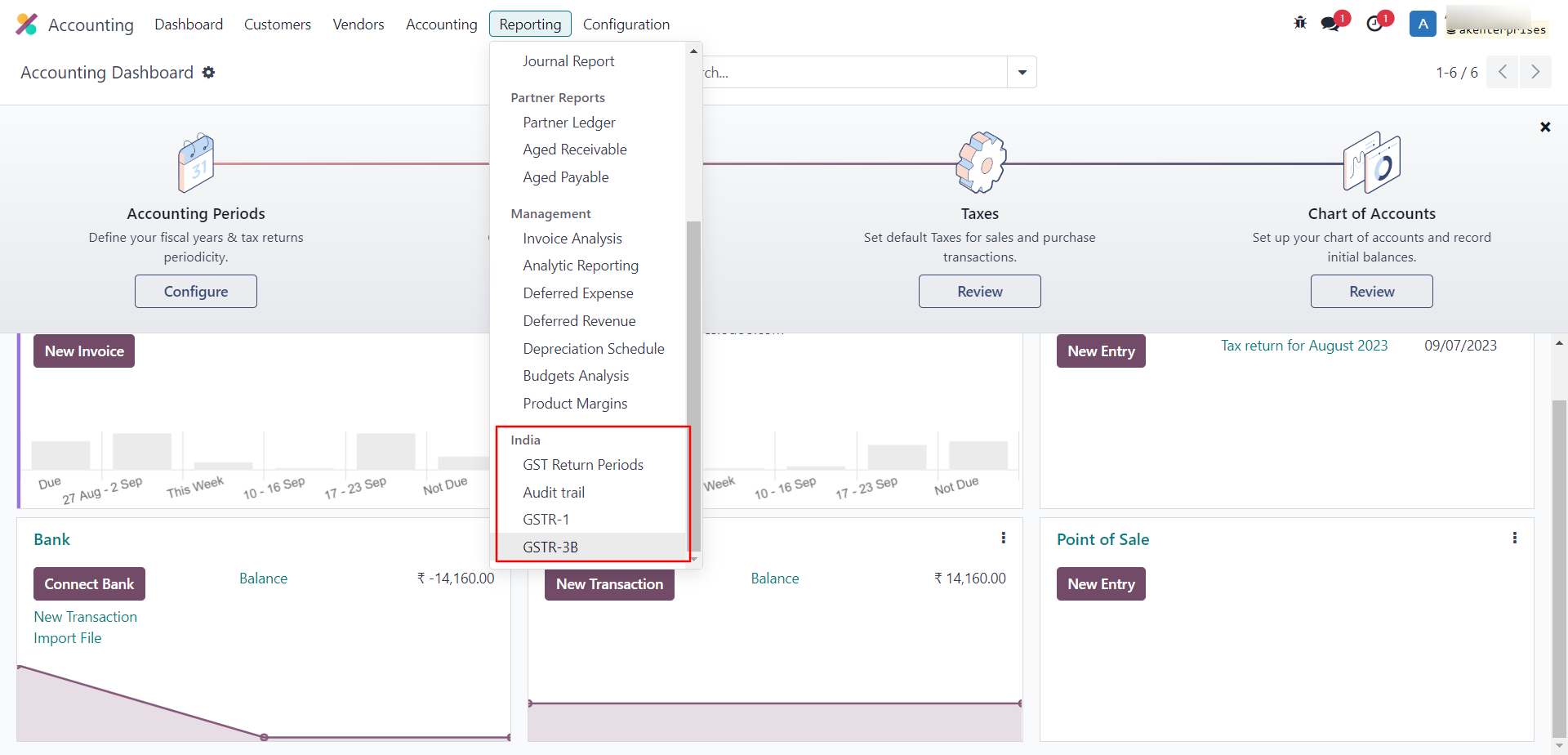

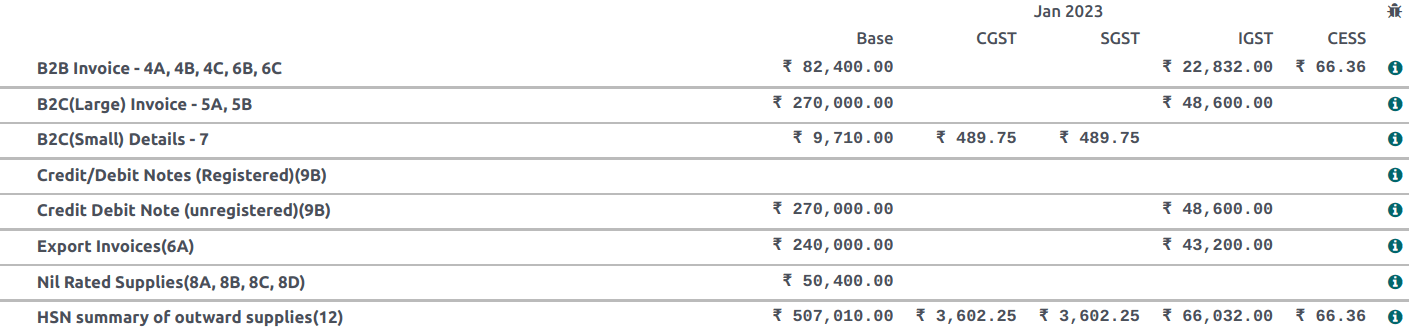

The GSTR-1 report is divided into sections: B2B Invoice, B2C Invoice (Large), B2C Invoice (Small), Credit and Debit Notes, Export Invoices, Nil Rated Supplies, and HSN Summary. It displays the Base amount, CGST, SGST, IGST, and CESS for each section.

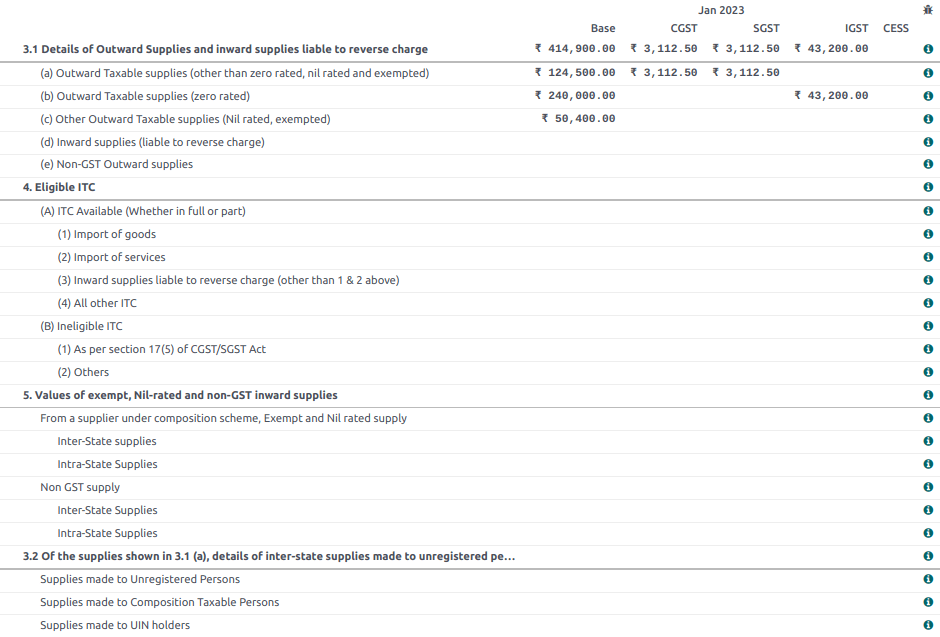

The GSTR-3B report contains different sections: Details of inward and outward supply subject to a reverse charge, Eligible ITC, Values of exempt, Nil-rated, and non-GST inward supply, and the details of inter-state supplies made to unregistered persons. It displays the Base amount, CGST, SGST, IGST, and CESS for each section.

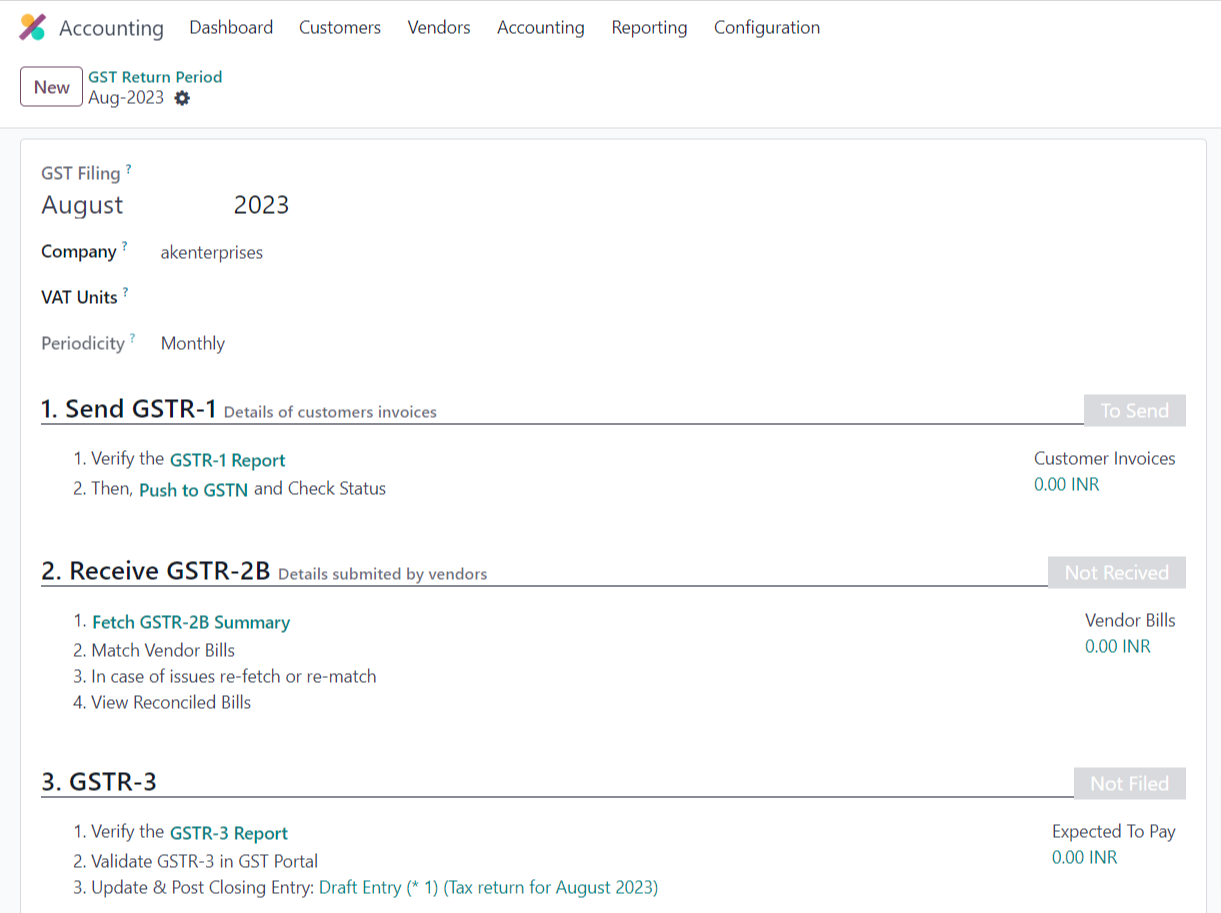

In order to file a GST Return, the user needs to complete the following steps:

Step 1: Send GSTR-1

Step 2: Receive GSTR-2B

Step 3: Submit GSTR-3

In summary, Odoo 17 simplifies GST reporting, offering detailed insights into your taxes and supplies. With a clear step-by-step guide, you can streamline your GST filing process for compliance and smooth workflow.

0